Harmonic Patterns

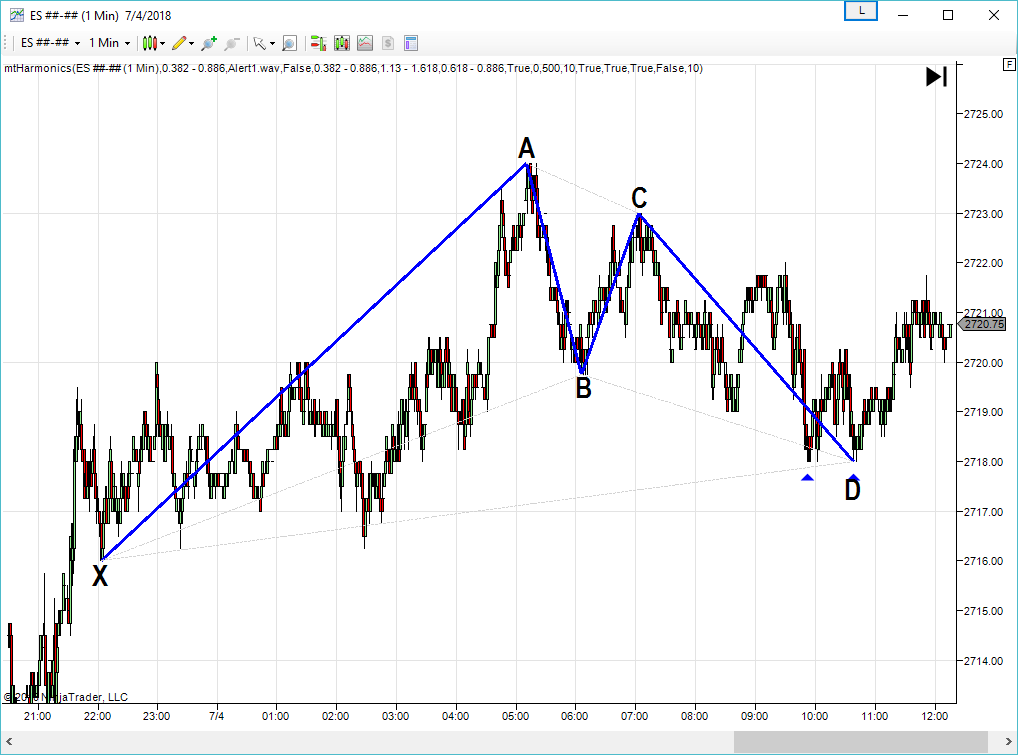

Harmonic patterns are formed when a sequence of run-ups and pullbacks in the market adhere to predefined ratios (typically Fibonacci ratios). Many traders use Harmonic patterns in an attempt to identify key turning points in the markets, as well as predictions on future market movement. As seen in the image below, Harmonic patterns are typically comprised of five swing highs and lows (Marked X, A, B, C, D in the image), which then form four “legs” (XA, AB, BC, CD). If the ratios between each of the legs adhere to the predefined ratios, a valid Harmonic pattern is formed.

Types of Harmonic Patterns

Several types of harmonic patterns exist. Most harmonic patterns consist of 4 legs, with the only difference being the ratios between the legs. Below is a list of some of the most common patterns, as well as the typical Fibonacci ratios used to identify them.

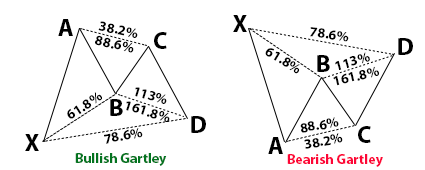

Gartley

- Leg AB is a 61.8% retracement of Leg XA

- Leg BC is a retracement of between 38.2% and 88.6% of Leg AB

- Leg CD is and extension of between 113% and 161.8% of Leg AB

- Leg CD is a retracement of 78.6% of Leg XA

Butterfly

- Leg AB is a 78.6% retracement of Leg XA

- Leg BC is a retracement of between 38.2% and 88.6% of Leg AB

- Leg CD is and extension of between 161.8% and 224% of Leg AB

- Leg CD is a retracement of 127% of Leg XA

Bat

- Leg AB is a retracement of between 38.2% and 50% of Leg XA

- Leg BC is a retracement of between 38.2% and 88.6% of Leg AB

- Leg CD is and extension of between 161.8% and 261.8% of Leg AB

- Leg CD is a retracement of 88.6% of Leg XA

Crab

- Leg AB is a retracement of between 38.2% and 61.8% of Leg XA

- Leg BC is a retracement of between 38.2% and 88.6% of Leg AB

- Leg CD is and extension of between 261.8% and 361.8% of Leg AB

- Leg CD is a retracement of 161.8% of Leg XA

Our Harmonic Pattern Indicator

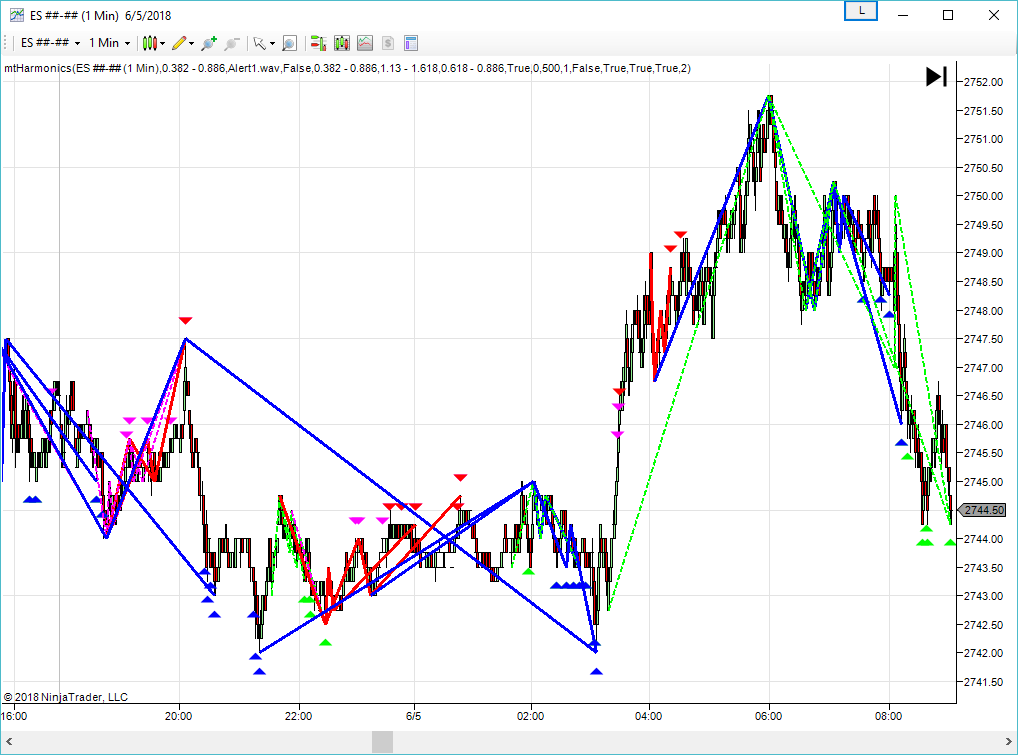

Harmonic patterns can be difficult to find manually. As seen in the image above, many patterns can be formed in a short time period, and patterns can exist within other patterns. Finding all of the possible legs and calculating the ratios between them takes a lot of time, which can result in missed trading opportunities. Our indicator will perform the calculations in just milliseconds, finding every pattern that meets the criteria.

Harmonic patterns can be difficult to find manually. As seen in the image above, many patterns can be formed in a short time period, and patterns can exist within other patterns. Finding all of the possible legs and calculating the ratios between them takes a lot of time, which can result in missed trading opportunities. Our indicator will perform the calculations in just milliseconds, finding every pattern that meets the criteria.

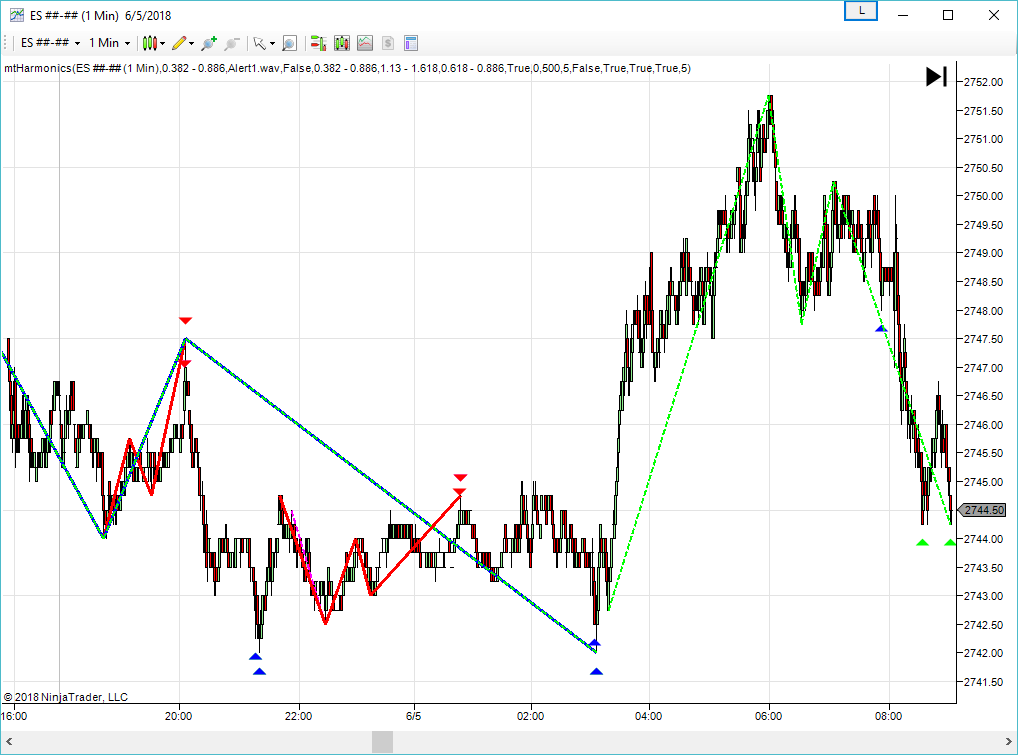

The image above shows how many patterns the indicator is capable of finding. It is looking for patterns forming using some less significant high and low points. If we change a simple setting in the indicator to make it use more significant highs and lows, the indicator still finds many patterns, but the chart looks a lot cleaner. The image below shows the same chart using the more significant highs and lows.

Features

Features

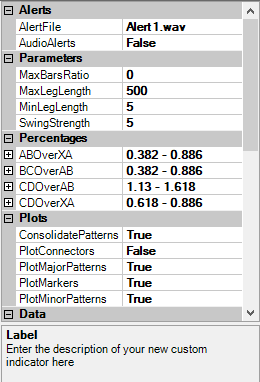

The indicator contains several parameters that allow user customization. Below are definitions for each parameter indicator:

The indicator contains several parameters that allow user customization. Below are definitions for each parameter indicator:

- AlertFile – .wav file used for audio alerts when patterns are found.

- AudioAlerts – allows the user to enable/disable audio alerts

- MaxBarsRatio – the longest leg (the one that spans the most bars) must be no more than this multiple of the shortest leg. This can be disabled by setting the value to 0.

- MaxLegLength – no leg in the pattern can span more bars than this amount.

- MinLegLength – no leg in the pattern can span less bars than this amount.

- SwingStrength – determines the significance of the swing highs and lows used to form each leg. When set to 5, each swing point must be a 5 bar high or low to be considered.

- ABOverXA – allows the user to modify the minimum and maximum percentages allowed for the AB/XA ratio.

- BCOverAB – allows the user to modify the minimum and maximum percentages allowed for the BC/AB ratio.

- CDOverAB – allows the user to modify the minimum and maximum percentages allowed for the CD/AB ratio.

- CDOverXA – allows the user to modify the minimum and maximum percentages allowed for the CD/XA ratio.

- ConsolidatePatterns – many times, the indicator will find patters that are almost identical. Plotting all of them on the chart can cause clutter. When set to true, this parameter will consolidate similar patterns and only plot the most significant one (the one that spans the most bars).

- PlotConnectors – determines whether the connector lines are plotted with the patterns.

- PlotMajorPatterns – determines whether Major patterns are plotted. Major patterns are defined as patterns where the swing high/low labeled ‘X’ is a higher high or lower low.

- PlotMarkers – determines whether the chart markers to show where patterns occurred are plotted

- PlotMinorPatterns – determines whether Minor patterns are plotted. Minor patterns are defined as patterns where the swing high/low labeled ‘x’ is a lower/equal high or higher/equal low.

No other products compare when it comes to detecting Harmonic patterns in NinjaTrader!

How To Purchase

Purchase a LIFETIME LICENSE for only $199.95. Simply Click the button below to add the item to your cart, then click the “My Cart” link at the top of this page to proceed to the checkout. NO REFUNDS, ALL SALES ARE FINAL!

Available for NinjaTrader 7 and NinjaTrader 8

Additional Information

If you would like more information about our Harmonic Pattern Indicator for NinjaTrader, please email us at info@freeindicators.com.