NinjaTrader Volatility Indicator Typically in technical analysis, traders will use the Standard Deviation as a measure of volatility. While this tends to be a fairly accurate, there are some flaws in the typical calculations which I have addressed in my NinjaTrader Volatility Indicator. The first step in calculating the Standard Deviation is to calculate the …

Tag: Volatility

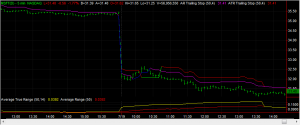

The Trouble With the ATR Trailing Stop Indicator

The Trouble With the ATR Trailing Stop Indicator The ATR Trailing Stop Indicator relies on the calculation of the True Range. True Range and the Average True Range (ATR) are a commonly used value in automated trading. The ATR) value is commonly used to determine volatility in the markets. It is used by Futures, Forex, …

Free Bollinger Bands – Addressing Inefficiencies With Bollinger Bands

Free Bollinger Bands Indicator for TradeStation and NinjaTrader What makes our free Bollinger Bands indicator better than others? Bollinger Bands are a simple yet effective tool for measuring overbought and oversold (support and resistance) conditions in the markets. Bollinger bands are effective for Futures, Forex, and Equities trading. Typically, Bollinger Bands will plot a channel …